VC’s Start With Their Gut. BPN Pressure-Tests It.

Don’t Lose Your Mind (or Your Money) Because You Didn’t Do the Work

Every VC knows the mantra: great founder, winning product, growing market.

We agree, wholeheartedly.

But we’ve also seen far too many investments where unit economics, scaling costs, and capital intensity quietly destroy returns, often because the competitive advantage wasn’t as durable as it first appeared.

In fast-growing, early-stage companies, every decision is made under uncertainty. Overly detailed spreadsheets don’t help. What does help is building logical scenarios, grounded in your thesis and the available facts, that translate judgment into realistic numbers for growth, profitability, and scale.

That’s the difference between having conviction and hoping you’re right.

Why “Smarter” LLMs Still Fall Short for Real VC Work

You’re not going to get meaningful help from Gemini 3 Pro, despite its substantially improved reasoning capabilities.

Yes, Gemini has expanded impressively across text, images, audio, and video. And yes, it can summarize information quickly, as can any modern AI. But summarization is not investment reasoning.

What actually matters is stress-testing your intuition:

How defensible is the product?

How fragile is the customer base?

Where does the competitive edge really come from?

Which assumptions must hold true for the deal to work?

You need to pressure-test those beliefs with hard facts, third-party proof points, and structured downside thinking, not just a polished narrative.

AI is great for getting a fast start. But serious investors also need the ability to go deep where conviction is weakest, and to quickly rebuild scenarios as information changes.

The Real Requirement: Controllable, Investment-Grade AI

Despite the advances of GPT-5.1 and Gemini 3 Pro, both tools we genuinely like and use daily, applying AI to real fund work requires something fundamentally different.

You need AI that is:

Fully configurable

Controllable

Grounded in numbers, not prose

Mapping hard evidence against your “gotta-believe” assumptions and sketching out how the business could realistically unfold is work worth doing. But it requires an efficient, structured process, one that translates judgment into decision-ready scenarios without turning into spreadsheet theater.

Why Standalone LLMs Still Break Down

Like Gemini 3 Pro, GPT-5.1 is a meaningful step forward, particularly in following multi-step instructions. But it still fails at a critical task:

capturing and manipulating the logic encoded in an underlying spreadsheet model.

It can’t:

Understand where growth is really coming from

Adapt unit economics dynamically

Rebuild valuation logic as assumptions change

Customize analysis on the fly for each unique company

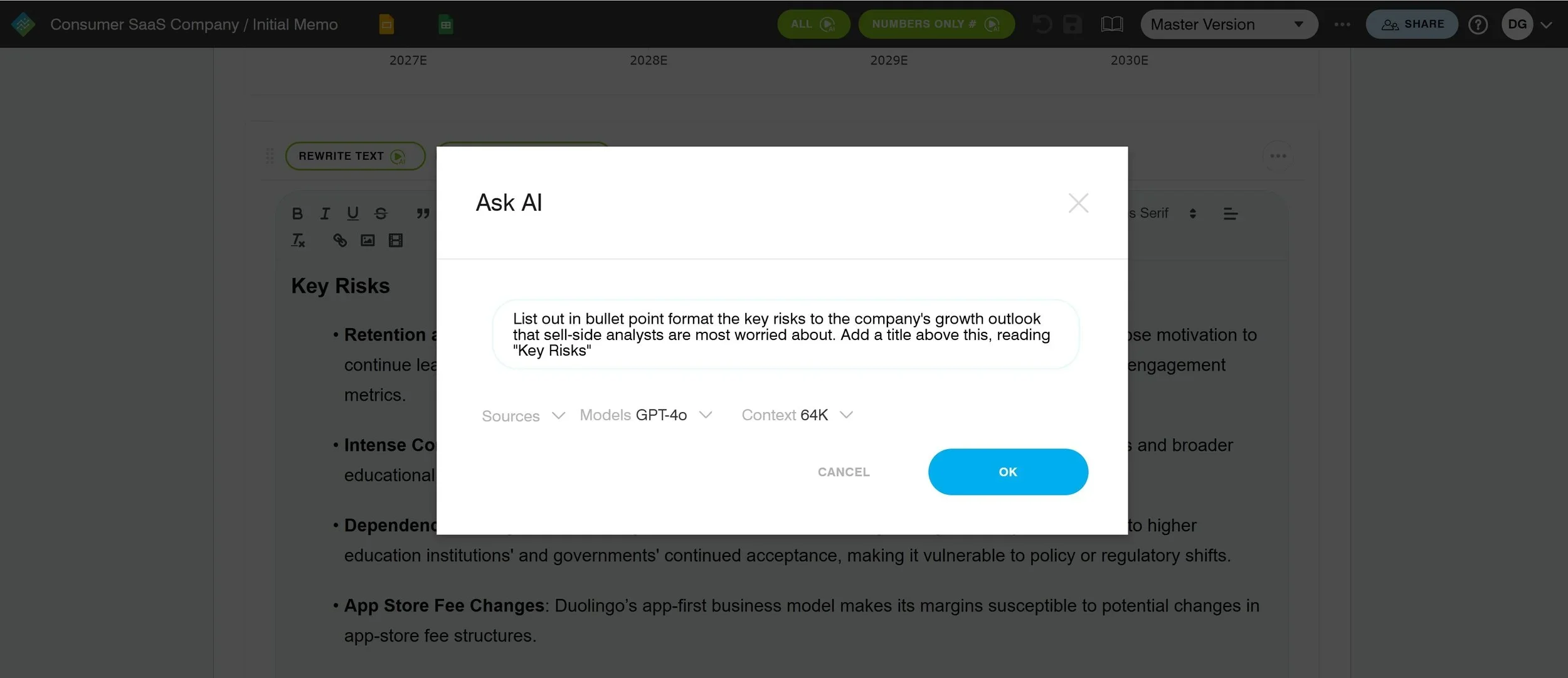

That’s why, inside the BPN Platform, you can use GPT-5.1 (or any supported LLM) within a proprietary, investment-specific framework, rather than relying on the model alone.

From Uploaded Files to Interpreted Business Logic

When a VC team uploads a spreadsheet into BPN, alongside the deck, data room, expert calls, and internal notes, we don’t just summarize the materials.

We interpret the logic of a connected spreadsheet:

Where is growth really coming from?

How long can it last?

What do unit economics imply at scale?

How does sales & marketing evolve with revenue?

Instead of typing arbitrary percentages into sensitivity tables, BPN understands the drivers of the business and simulates scenarios the way a serious investor would, given time, focus, and discipline.

Scenario Modeling the Way Investors Actually Think

Imagine a startup with strong topline growth but fragile retention.

You ask BPN:

“Build a downside assuming retention weakens for two quarters.”

In seconds, the system:

Recalculates revenue

Adjusts churn impact on ARR

Updates the cost structure

Recomputes burn and runway

Rewrites valuation logic

Instead of a hand-wavy assumption like “ARR growth tails off by 25% per year,” you get a fully reasoned case:

Retention deterioration compresses net expansion, slows ARR growth, increases cash burn, and shortens runway by three quarters.

This is scenario modeling grounded in your understanding of the business, not a black-box AI guess or a high-level gut feel.

After reviewing the outputs, your team can:

Adjust assumptions

All before cognitive bias sets in.

Closing the Gap Between Heuristics and Reality

Too often, VC teams rely on rough heuristics that miss:

True upside asymmetry: the kind that produces fund-returning outcomes

Hidden downside fragilities: the portfolio losers that quietly drain time and capital

BPN closes that gap by combining:

Your insight

Rigorously mapped evidence

Logical, scenario-based reasoning

For a top-quartile VC, a few winners still drive returns. But imagine how much better you could do if your AI platform was as disciplined, and as thoughtful, as you are.