Aligning Your Growth Equity Narrative With Your Spreadsheet Model

Using Opus 4 and BPN’s Case Builder

Growth Equity deals can move fast, especially for hot companies with strong momentum or rock-star founders. ARR accelerates. New logo adds come in. NRR expands. Pipeline quality improves. Hiring ramps. The next round launches before you’ve caught your breath.

Meanwhile, the volume of information compounds: data rooms of uneven depth, expert calls, market studies, internal notes, emails, CRM exports, and evolving spreadsheet models.

The challenge is never just “drafting a memo” or “updating the numbers.”

It’s keeping the investment narrative and the numbers aligned with the substantive reality of a fast-changing business, often one priced for a decade or more of growth.

The real job to be done is harder: thinking critically about the gotta-believe assumptions, exploring upside and downside cases rooted in sustainable competitive advantage and market structure, and making a disciplined decision about whether (and how much) to invest.

Why AI Should Help: and Why It Usually Doesn’t

In theory, AI should be well-suited to this problem.

Claude 4 (Opus 4), for example, was designed as a hybrid reasoning model capable of switching into an “extended thinking” mode for multi-step analytical tasks. That maps well to reading decks, 10-Ks, and spreadsheet models before drafting a memo.

Opus 4 also expanded its maximum context window to 200K tokens, roughly equivalent to 500 pages of documents or a dense, multi-tab spreadsheet.

But even that isn’t enough.

Growth Equity diligence rarely fits cleanly into a single session. Models evolve. New evidence arrives. Assumptions change. Narratives must be rewritten repeatedly. Standalone LLMs, no matter how capable, lack persistence, model awareness, and alignment with live spreadsheet logic.

How BPN Solves the Alignment Problem

BPN’s purpose-built AI + 1 Platform for investment research, spreadsheet analysis, and memo/slide creation solves this problem transformationally.

With your choice of GPT-5.2, Claude 4, Gemini 3 Pro, or Perplexity Reasoning Pro, BPN:

Applies battle-tested investment prompts across your entire data room

Connects directly to a trusted spreadsheet model

Ensures every model update is immediately reflected in:

Scenario reasoning

Valuation logic

A consistent written narrative

Crucially, your team retains full control:

Over the sources used

The assumptions set

The conclusions reached

With unmatched transparency back to both source documents and spreadsheet calculations.

From New Evidence to Updated IC Materials Automatically

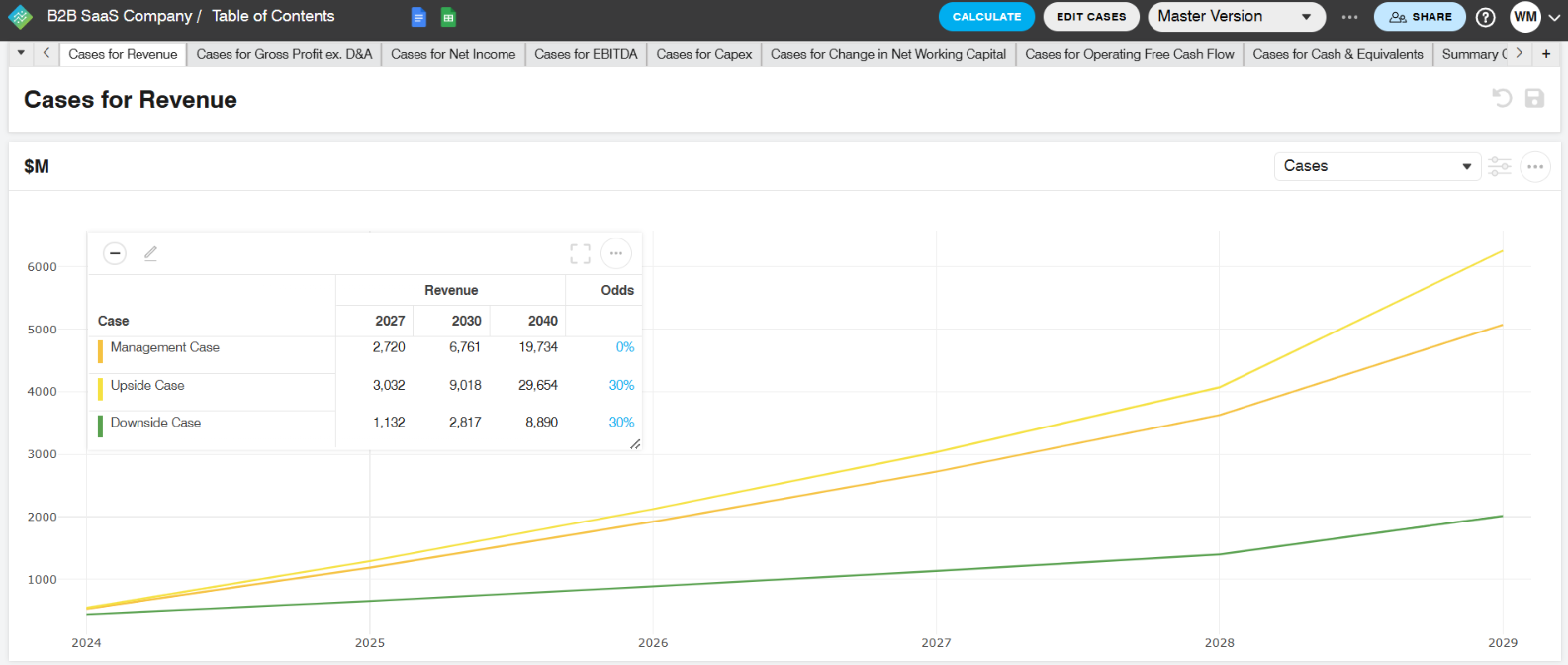

Imagine a Growth Equity team underwriting a usage-based software company.

New cohort data arrives showing slightly weaker expansion. You need to reflect that across:

The base case

The downside case

Valuation logic

IC-ready memo and slides

You ask BPN:

“Refresh the model using the new expansion data and rewrite the valuation narrative accordingly.”

BPN:

Maps the new evidence to specific spreadsheet assumptions

Updates valuation outputs

Rewrites the memo or slide logic to reflect the revised economics

Explaining, for example:

“Moderating expansion shifts long-term ARR composition away from upsell-driven growth, placing more weight on new business productivity and increasing sensitivity to sales efficiency.”

This is real Growth Equity reasoning, not surface-level summarization.

Keeping the Entire Investment Case in Sync

The best Growth Equity teams rely on:

Careful evidence review

Thoughtful scenario design

Clear understanding of driver interactions

Capital efficiency pathways

Trade-offs between growth and margin expansion

BPN keeps all of it aligned automatically.

Nothing drifts out of sync:

The memo

The model

The slides

The valuation story

The conclusions

All remain seamlessly connected.

Your team can still:

Edit inline

Adjust assumptions

Add new cases on the fly

Refine conclusions with judgment and nuance

Faster (and More Credible) Diligence

The result is a faster diligence process, yet surprisingly more credible.

Teams spend time debating assumptions, not reworking drafts

Associates avoid endless revisions as diligence evolves

Senior partners and IC members receive updates that accurately reflect the state of the business in real time

As the company evolves (week by week or quarter by quarter), the investment case evolves with it, without losing coherence.

That’s what it means to truly align your Growth Equity narrative with your spreadsheet model.